The world of trading offers numerous chart patterns to help traders make informed decisions. One of the most popular and widely recognized patterns is the Triple Top Pattern. This pattern is a crucial part of technical analysis, and traders use it to predict potential reversals in an asset’s price movement.

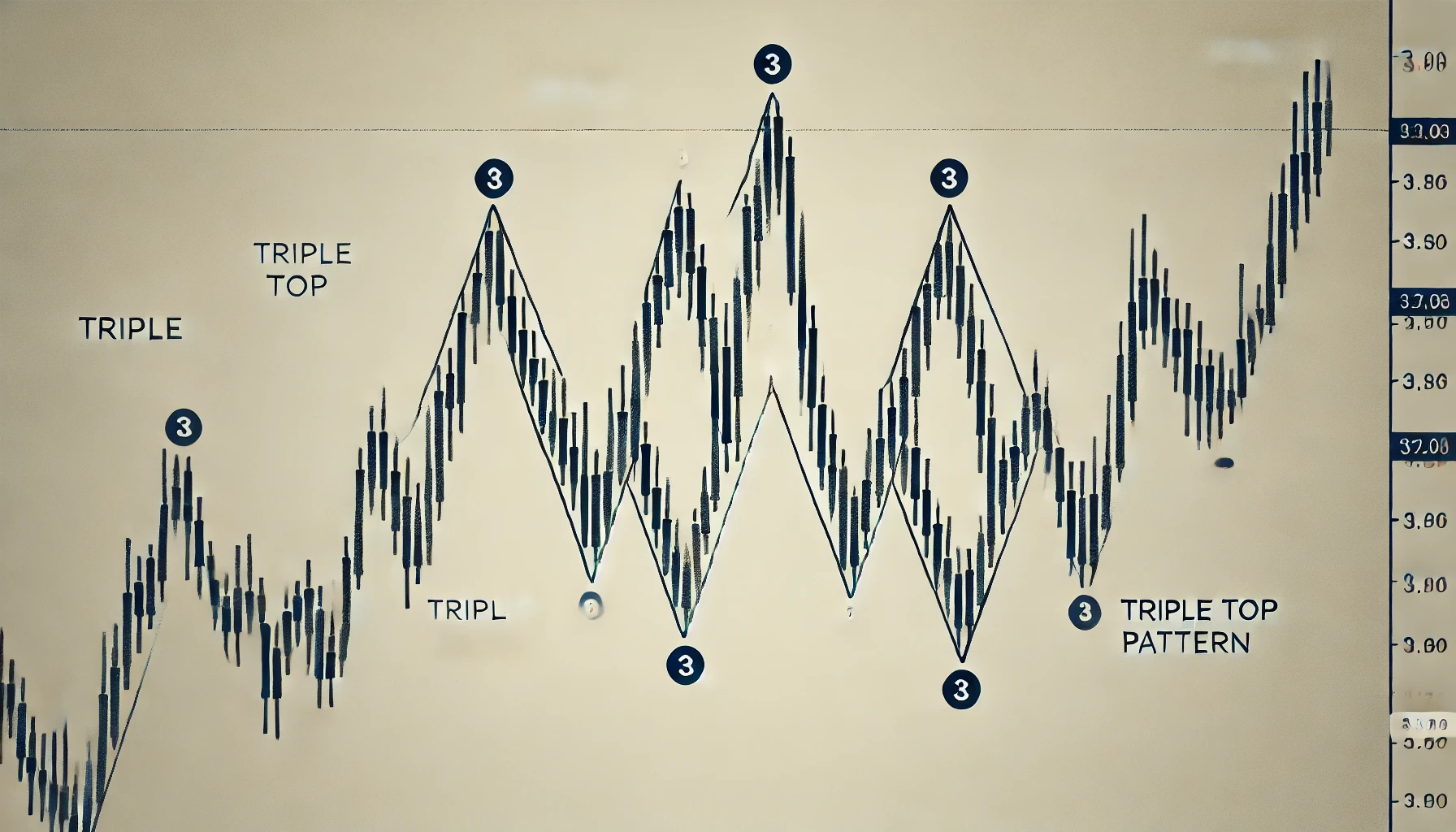

The Triple Top Pattern is a bearish reversal pattern that signals the end of an uptrend and the beginning of a potential downtrend. It forms when the price makes three peaks at roughly the same level, followed by a break below the support level, often referred to as the neckline. This pattern is essential for traders as it provides a clear signal that the buyers are losing control, and sellers are likely to take over.

In this blog, we will dive deep into the Triple Top Pattern, how to identify it, strategies for trading it, and real-life examples of its effectiveness.

Formation of the Triple Top Pattern

The Triple Top Pattern consists of three distinct peaks that occur at approximately the same price level. This pattern forms over a period of time and usually indicates that the upward momentum of a stock or asset is waning. The formation of the Triple Top Pattern follows a specific sequence of events:

- First Peak: The asset’s price rises due to strong demand, but eventually, it meets resistance, leading to a slight pullback.

- Second Peak: After the pullback, the price attempts to rise again and reaches the same resistance level as the first peak but fails to break through, causing another decline.

- Third Peak: In the final attempt, the price rises once more to the same resistance level, but the buyers cannot push it higher. This failure results in a sharp decline, breaking the support (neckline).

The key element of this pattern is the neckline, which acts as a support level during the formation. When the price breaks below the neckline after the third peak, it confirms the reversal, signaling a bearish trend.

Key Characteristics of a Valid Triple Top Pattern

- Three Peaks: All three peaks should occur at roughly the same price level, signaling strong resistance.

- Declining Volume: Volume tends to decrease as the pattern forms, especially during each subsequent peak, indicating waning buying pressure.

- Break of Support: The final confirmation comes when the price breaks below the neckline with increased volume.

Timeframes for Analysis: Short-Term vs. Long-Term

The Triple Top Pattern can form over various timeframes, from short-term intraday charts to long-term daily or weekly charts. While shorter timeframes provide more frequent opportunities, longer timeframes tend to offer stronger signals. Traders should carefully choose the timeframe that aligns with their trading strategy and risk tolerance.

Identifying the Triple Top Pattern

Recognizing the Triple Top Pattern early on can give traders a significant edge in anticipating market movements. Here’s how to identify this pattern effectively:

- Use Appropriate Chart Types: The Triple Top Pattern is best viewed on candlestick or bar charts, where price movements are clear. Line charts may also work, but they lack the level of detail needed for precise analysis.

- Focus on the Resistance Level: The price peaks should occur around the same level, indicating a strong resistance zone. If the peaks are too far apart, it may not be a reliable pattern.

- Volume Confirmation: Volume plays a crucial role in confirming the validity of the pattern. During the formation of the pattern, volume tends to decline, especially at each peak. However, when the price breaks below the neckline, volume should increase, confirming the bearish trend.

- Neckline Identification: The support level, or neckline, should be clearly identified. This level represents the lowest point between the peaks. A break below this line is crucial for the confirmation of the pattern.

- Avoid Common Mistakes: One common mistake traders make is identifying peaks that aren’t equidistant or have significant price differences. Ensure that the three peaks are relatively close in price and evenly spaced.

Trading the Triple Top Pattern

Once the Triple Top Pattern is identified, the next step is to develop a strategy for trading it. Traders typically use this pattern to enter short positions or exit long positions, as it signals a potential reversal. Below are some key trading strategies:

- Entry Strategy:

- The ideal entry point for trading the Triple Top Pattern is when the price breaks below the neckline. Wait for the price to close below this support level before entering a short position.

- More conservative traders may wait for a retest of the neckline after the breakout. If the price moves back to the neckline and then resumes its downward trend, it provides a safer entry point.

- Stop-Loss Placement:

- A well-placed stop-loss is crucial when trading the Triple Top Pattern. One of the most common stop-loss strategies is placing the stop above the third peak. This ensures that the trade is protected if the price reverses and breaks above the resistance level.

- Alternatively, some traders place their stop-loss slightly above the neckline to minimize risk in case of a false breakout.

- Take Profit Targets:

- The distance from the neckline to the peaks is typically used to determine the target profit level. This distance is measured and projected downwards from the neckline to set a realistic profit target.

- Traders should also consider using trailing stops to lock in profits as the price continues to move in their favor.

- Breakout Confirmation:

- Breakout confirmation is essential when trading the Triple Top Pattern. Without confirmation, traders risk entering trades based on false signals. Look for increased volume during the breakout and ensure that the price closes below the neckline before committing to the trade.

Real-Life Examples of Triple Top Patterns

The Triple Top Pattern has been successfully used by traders across various markets, including stocks, forex, and commodities. Below are a few real-life examples to illustrate the pattern’s effectiveness:

- Stock Market Example:

- In a well-known case, Apple Inc. (AAPL) formed a Triple Top Pattern in 2020. After the third peak, the price failed to break through resistance and eventually broke below the neckline. This led to a significant decline, providing traders with a profitable short-selling opportunity.

- Forex Market Example:

- In the forex market, the EUR/USD currency pair exhibited a Triple Top Pattern in 2019. The three peaks occurred at the same resistance level, and after the neckline was broken, the pair entered a bearish trend, allowing forex traders to capitalize on the move.

- Commodity Market Example:

- Gold futures also demonstrated a classic Triple Top Pattern in 2021. The price attempted to break through resistance three times but failed. Once the neckline was broken, the price of gold dropped, confirming the reversal.

Risks and Limitations of the Triple Top Pattern

While the Triple Top Pattern is a reliable technical analysis tool, it is not without its risks and limitations. Traders must be aware of the following potential pitfalls:

- False Breakouts:

- One of the most significant risks when trading the Triple Top Pattern is false breakouts. Sometimes the price may briefly dip below the neckline but then reverse, trapping traders in losing positions. To avoid this, always wait for confirmation before entering trades.

- Pattern Failure:

- The Triple Top Pattern can fail if market conditions change unexpectedly. For instance, a sudden surge in buying pressure due to positive news can push the price above the resistance level, invalidating the pattern.

- Market Conditions:

- The pattern is most effective in stable market conditions. During highly volatile periods, the pattern may not provide reliable signals. Traders should combine the Triple Top Pattern with other technical indicators to increase the chances of success.

- Combining with Other Indicators:

- The Triple Top Pattern should not be used in isolation. For more accurate predictions, traders often combine it with other indicators like the Relative Strength Index (RSI), Moving Averages (MA), and Fibonacci retracements to validate the pattern.

Conclusion

The Triple Top Pattern is a powerful tool in a trader’s arsenal, helping them identify potential reversals and capitalize on bearish trends. By understanding its formation, learning how to spot it, and applying effective trading strategies, traders can increase their chances of success.

However, like all technical analysis tools, the Triple Top Pattern is not foolproof. It requires careful analysis, patience, and the use of complementary indicators to maximize its effectiveness. Whether you are trading stocks, forex, or commodities, mastering this pattern can lead to profitable trading opportunities in the right conditions.

By staying vigilant for false signals and adapting your strategy based on market conditions, the Triple Top Pattern can become a reliable tool in your trading toolkit.