Technical analysis plays a significant role in financial markets, helping traders make well-informed decisions based on price patterns and historical data. One of the most essential bullish reversal patterns is the Triple Bottom Pattern. This pattern indicates the possible end of a downtrend and the beginning of a new uptrend, signaling a potential buying opportunity.

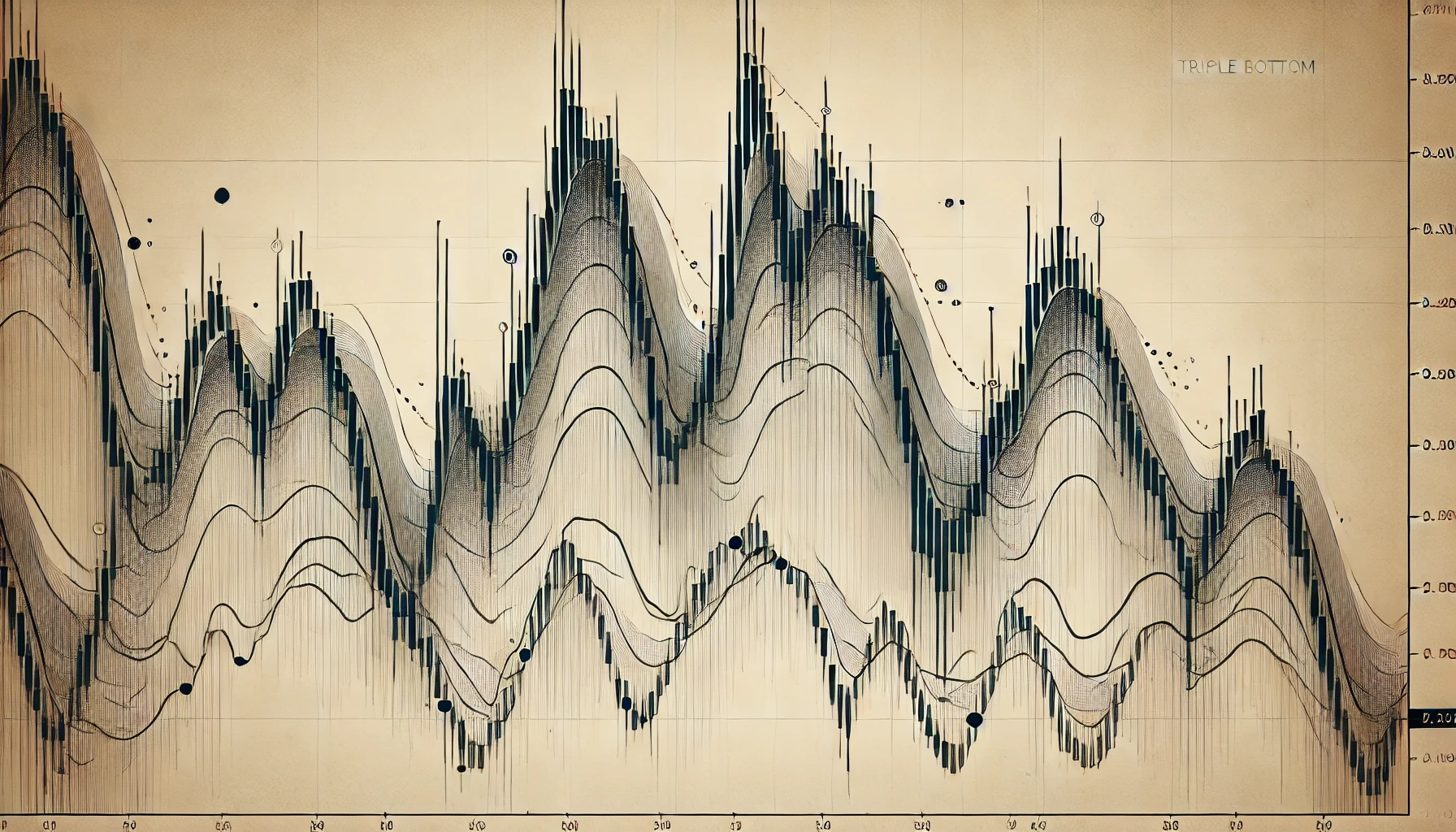

The Triple Bottom Pattern is recognized by three successive troughs (lows) occurring at approximately the same price level, followed by a breakout above a resistance level known as the neckline. It is a clear indication that selling pressure is diminishing and buying interest is gaining momentum.

This blog delves into how traders can identify, trade, and capitalize on the Triple Bottom Pattern, including real-world examples and potential risks.

Formation of the Triple Bottom Pattern

The Triple Bottom Pattern consists of three distinct lows, or troughs, that occur at approximately the same price level over a specific period. This pattern forms during a downtrend and signals the weakening of bearish momentum. The stages of the formation include:

- First Trough: The price falls due to selling pressure but finds support at a certain level, causing a bounce.

- Second Trough: After the bounce, the price once again declines to the same support level, failing to break through. This signifies a potential reversal as buyers step in.

- Third Trough: The price drops for a final time but fails to make a lower low. This third trough confirms the pattern when followed by a breakout above the neckline.

The key element of this pattern is the neckline, which acts as a resistance level during the formation. When the price breaks above the neckline, it signals that the sellers have been overpowered, and a bullish reversal is likely.

Key Characteristics of a Valid Triple Bottom Pattern

- Three Distinct Lows: Each of the three troughs should occur at approximately the same price level, suggesting strong support.

- Volume Trends: Volume tends to decrease during the formation of the pattern and increases significantly during the breakout above the neckline.

- Breakout Confirmation: The final confirmation comes when the price breaks above the neckline, indicating a shift in market sentiment.

The Significance of Timeframes: Short-Term vs. Long-Term

The Triple Bottom Pattern can appear across various timeframes, from short-term intraday charts to long-term weekly or monthly charts. Traders should consider the timeframe that suits their trading strategy:

- Short-Term: On short-term charts, the pattern provides quick trading opportunities but may result in more frequent false breakouts.

- Long-Term: On longer-term charts, the pattern offers stronger and more reliable signals, although the formation may take longer.

How to Identify the Triple Bottom Pattern

Successfully identifying the Triple Bottom Pattern can provide traders with early signals to enter a bullish market. Here’s how to spot it:

- Use of Candlestick Charts: Candlestick charts provide the best way to identify the Triple Bottom Pattern, as they clearly display price movement. Each trough should be easily visible on the chart.

- Watch the Resistance Level (Neckline): The neckline acts as a resistance level during the formation. Traders should pay close attention to this line, as a breakout above it signals the start of a bullish trend.

- Volume Confirmation: Volume is a critical factor in confirming the validity of the Triple Bottom Pattern. Typically, volume decreases as the pattern forms, but there is a significant increase in volume when the price breaks above the neckline.

- Avoid False Patterns: Make sure that the lows are relatively equal in price. A pattern with varying lows may not be a reliable Triple Bottom. Additionally, ensure that the spacing between the troughs is somewhat consistent.

Trading the Triple Bottom Pattern

Once you have identified the Triple Bottom Pattern, the next step is executing a trading strategy. Traders often look to enter long positions as this pattern signals the end of a downtrend. Below are some essential strategies for trading this pattern:

- Entry Strategy:

- Enter the trade once the price breaks above the neckline with increased volume. This breakout signals a confirmed bullish reversal, providing a prime entry point for long positions.

- More conservative traders may wait for a pullback to the neckline after the breakout before entering a trade. This helps ensure that the breakout is legitimate.

- Stop-Loss Placement:

- To protect against potential losses, place a stop-loss below the third trough. This stop-loss level minimizes risk if the breakout fails and the price reverses.

- Profit Targets:

- Measure the distance between the neckline and the troughs and project this distance upwards from the breakout point to establish a target price. This method provides a realistic profit target for traders.

- Breakout Confirmation:

- Breakout confirmation is essential. Look for an increase in volume during the breakout to confirm the pattern. A false breakout with low volume could lead to losses if the trade is entered prematurely.

Real-Life Examples of Triple Bottom Patterns

The Triple Bottom Pattern has appeared in various financial markets, providing profitable opportunities for traders. Here are some real-world examples of this pattern in action:

- Stock Market Example:

- In a notable example, Tesla (TSLA) exhibited a Triple Bottom Pattern in 2018. After forming three distinct troughs, the price broke above the neckline, leading to a strong uptrend, providing significant gains for traders who identified the pattern early.

- Forex Market Example:

- The GBP/USD currency pair showed a Triple Bottom Pattern in 2020. After forming the pattern over several weeks, the pair broke above the neckline, signaling the beginning of a new bullish trend.

- Cryptocurrency Example:

- Bitcoin (BTC) also demonstrated a Triple Bottom Pattern in early 2021. After the third trough, the price surged, confirming the bullish reversal and resulting in a rally that led to significant gains.

Risks and Limitations of the Triple Bottom Pattern

While the Triple Bottom Pattern is a reliable indicator of a bullish reversal, traders must be aware of its limitations:

- False Breakouts:

- One of the primary risks associated with this pattern is the occurrence of false breakouts. These false signals can trap traders into entering long positions prematurely. To mitigate this risk, always wait for volume confirmation before entering a trade.

- Pattern Failure:

- The Triple Bottom Pattern can fail if external factors or market conditions change unexpectedly. For example, sudden negative news or economic events can cause the price to drop, invalidating the pattern.

- Market Conditions:

- This pattern works best in relatively stable market conditions. During periods of extreme volatility, such as during economic downturns or major geopolitical events, the pattern may not provide reliable signals.

- Combining with Other Indicators:

- The Triple Bottom Pattern should not be used in isolation. For more accurate predictions, traders often combine it with other technical indicators like the Moving Average (MA), Relative Strength Index (RSI), and Fibonacci retracement levels.

Conclusion

The Triple Bottom Pattern is a powerful tool for traders looking to capitalize on bullish reversals. Its clear formation, marked by three distinct troughs and a breakout above the neckline, provides traders with an excellent opportunity to enter long positions.

However, like all technical analysis tools, the Triple Bottom Pattern requires careful analysis and should not be used in isolation. Traders must be cautious of false breakouts and ensure that they wait for volume confirmation before making any trades. By combining this pattern with other indicators and risk management strategies, traders can maximize their chances of success.

Understanding and mastering the Triple Bottom Pattern can give traders a valuable edge in their pursuit of profitable trades. Whether you are trading stocks, forex, or cryptocurrencies, incorporating this pattern into your strategy can lead to successful trades in the right market conditions.