In the world of trading and technical analysis, chart patterns play a significant role in helping traders forecast future price movements. One such important pattern is the Rising Wedge Pattern, which signals a potential reversal in the market’s current trend. Whether you’re trading stocks, forex, or cryptocurrencies, recognizing this pattern can provide you with a valuable advantage.

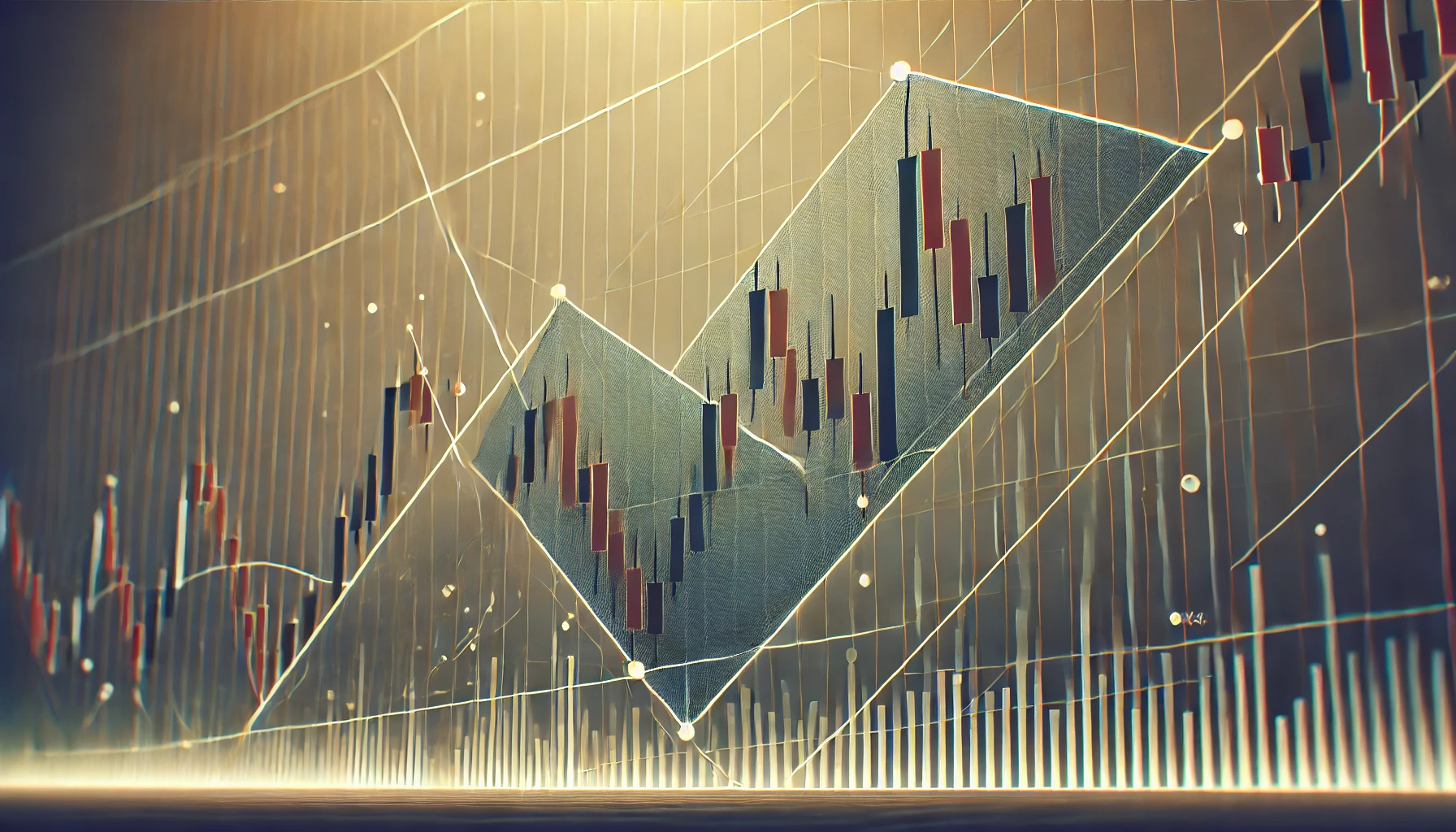

The Rising Wedge Pattern is a bearish reversal pattern that forms when price movement is contained within two upward-sloping trendlines that converge as the pattern progresses. As the price climbs within this narrowing range, traders interpret it as a signal that the asset’s bullish momentum is weakening, and a downside reversal may be imminent.

This blog will dive deep into the structure, identification, and trading strategies associated with the Rising Wedge Pattern, offering a comprehensive guide for traders.

Formation of the Rising Wedge Pattern

The Rising Wedge Pattern consists of two upward-sloping trendlines that converge over time. The price fluctuates within these trendlines, forming a narrowing range. The pattern forms during an uptrend and typically indicates that bullish momentum is weakening. Here’s a breakdown of the key elements of the pattern:

- Two Converging Trendlines:

- The top trendline connects the highs of the price movement, while the bottom trendline connects the lows. Both trendlines slope upwards, but the upper line rises at a slower pace than the lower one, causing the lines to converge.

- Narrowing Range:

- As the price moves within the two trendlines, the range becomes progressively narrower, indicating a weakening trend. This tightening of price action is a signal that buyers are losing control, and sellers may take over soon.

- Breakdown of the Lower Trendline:

- The final confirmation of a Rising Wedge Pattern comes when the price breaks below the lower trendline. This breakdown is often accompanied by an increase in volume, signaling a bearish reversal.

Bullish vs. Bearish Rising Wedge

While the Rising Wedge is typically a bearish reversal pattern, it can occasionally appear as a continuation pattern in a strong uptrend. In such cases, the price may break upwards after forming the wedge, although this is less common. Most traders view the pattern as a signal that a bearish reversal is likely to occur, especially after a prolonged uptrend.

Market Conditions and the Rising Wedge Pattern

The Rising Wedge Pattern is particularly useful in identifying trend reversals in bullish markets. As buyers push the price higher, the narrowing range suggests that the upward momentum is fading. Eventually, sellers gain control, leading to a breakdown and a bearish reversal. This pattern can appear across various timeframes, from short-term intraday charts to longer-term weekly or monthly charts.

Identifying the Rising Wedge Pattern

Recognizing the Rising Wedge Pattern early can give traders an edge in predicting price reversals. Here are the steps to correctly identify this pattern:

- Converging Trendlines:

- Look for two upward-sloping trendlines that converge as the price moves higher. The upper trendline should connect the series of higher highs, and the lower trendline should connect the higher lows.

- Narrowing Range:

- The distance between the highs and lows should gradually decrease as the price approaches the end of the wedge. This narrowing of the range is a key characteristic of the pattern.

- Volume Decline:

- As the pattern forms, volume typically declines, indicating reduced buying interest. When the price finally breaks below the lower trendline, there is usually a sharp increase in volume, confirming the bearish breakout.

- Timeframes:

- The Rising Wedge can be identified across various timeframes, including intraday, daily, and weekly charts. Longer timeframes tend to provide more reliable signals, while shorter timeframes may be prone to false breakouts.

Common Mistakes in Identifying the Rising Wedge Pattern

- Incorrect Trendline Placement: Ensure that the trendlines correctly connect the highs and lows of the price movement. If the lines are not converging, the pattern may not be valid.

- Ignoring Volume: Volume is a crucial factor in confirming the validity of the pattern. A lack of volume during the breakdown can result in a false signal.

- Misinterpreting the Range: The range between the highs and lows should narrow as the pattern progresses. If the range remains wide, it may not be a Rising Wedge.

Interpreting the Rising Wedge Pattern in Trading

The Rising Wedge Pattern is a signal of bearish reversal and reflects weakening bullish momentum. Here’s what it means in trading:

- Bearish Reversal Signal:

- The pattern typically forms at the top of an uptrend and signals that the bullish momentum is fading. Once the price breaks below the lower trendline, it indicates that sellers have gained control, and a bearish reversal is likely.

- Market Psychology:

- The Rising Wedge reflects indecision in the market. Buyers continue to push the price higher, but the narrowing range indicates that they are losing strength. Sellers eventually step in and drive the price lower.

- Confirmation of Reversal:

- A breakdown below the lower trendline, accompanied by increased volume, provides confirmation that the pattern is valid and that a reversal is underway.

Trading Strategies for the Rising Wedge Pattern

Once you’ve identified a valid Rising Wedge Pattern, you can develop a trading strategy based on its bearish implications. Here are some strategies to consider:

- Entry Strategy:

- Enter a short position once the price breaks below the lower trendline. This breakdown is the key signal that the uptrend has ended, and the price is likely to decline further.

- Conservative traders may wait for a retest of the broken trendline as resistance before entering the trade. This retest provides additional confirmation that the breakdown is legitimate.

- Stop-Loss Placement:

- Place a stop-loss just above the upper trendline or the recent high to protect against the possibility of a continuation of the uptrend. This helps limit potential losses if the breakout fails.

- Take-Profit Targets:

- Measure the distance between the upper and lower trendlines at the start of the wedge. This distance can be projected downwards from the point of the breakdown to set a profit target. Additionally, traders can use support levels or Fibonacci retracement levels to determine where to exit the trade.

- Combining with Other Indicators:

- Use additional technical indicators, such as the Relative Strength Index (RSI), Moving Averages (MA), or the MACD (Moving Average Convergence Divergence), to confirm the bearish reversal before entering a trade.

Real-Life Examples of Rising Wedge Patterns

The Rising Wedge Pattern can be found in various financial markets, including stocks, forex, and cryptocurrencies. Below are some real-world examples:

- Stock Market Example:

- In 2021, Tesla (TSLA) formed a Rising Wedge Pattern after a strong uptrend. The price moved within the narrowing range, and after breaking below the lower trendline, the stock experienced a significant decline.

- Forex Market Example:

- The EUR/USD currency pair displayed a Rising Wedge Pattern in 2020. After forming the wedge, the price broke down, leading to a bearish reversal that forex traders capitalized on.

- Cryptocurrency Example:

- Bitcoin (BTC) also exhibited a Rising Wedge Pattern in early 2021. After the price broke below the lower trendline, the cryptocurrency experienced a sharp decline, providing a profitable opportunity for traders who recognized the pattern.

Risks and Limitations of the Rising Wedge Pattern

While the Rising Wedge Pattern is a valuable tool for predicting bearish reversals, it comes with certain risks and limitations:

- False Breakouts:

- One of the most significant risks is the occurrence of false breakouts. Sometimes the price may briefly dip below the lower trendline but then reverse and continue higher. Waiting for confirmation, such as increased volume, can help avoid false signals.

- Market Conditions:

- The Rising Wedge Pattern works best in trending markets. In choppy or sideways markets, the pattern may not provide reliable signals.

- Combining with Other Tools:

- To improve the accuracy of the pattern, traders should combine it with other technical analysis tools, such as moving averages, oscillators, or trend indicators.

Conclusion

The Rising Wedge Pattern is a powerful bearish reversal signal that can help traders anticipate market downturns and make informed trading decisions. By understanding its structure, learning how to identify it, and applying effective trading strategies, traders can use the pattern to their advantage.

However, like all technical analysis tools, the Rising Wedge Pattern should not be used in isolation. Combining it with other indicators and applying proper risk management techniques can improve the chances of success.

Mastering the Rising Wedge Pattern allows traders to recognize early signs of a market reversal, giving them a valuable edge in their trading strategies.