Fundamental Analysis is a method of evaluating a company’s intrinsic value by examining its financial data, economic conditions, industry trends, and management. It is a cornerstone for making informed investment decisions in the Indian share market, focusing on long-term growth and stability.

Unlike technical analysis, which relies on price movements and charts, fundamental analysis digs deep into the company’s core metrics to determine whether its stock is undervalued or overvalued.

Objectives of Fundamental Analysis

Determine Intrinsic Value :

Identify whether a stock is fairly priced compared to its market value.

Assess Financial Health :

Analyze financial statements to ensure the company is stable and profitable.

Understand Market Trends :

Evaluate how economic factors influence a company’s performance.

Make Long-Term Investments :

Use insights to build a portfolio with sustainable returns.

Components of Fundamental Analysis

1. Quantitative Analysis

Focuses on numerical data, primarily from financial statements.

Key Financial Metrics :

Earnings Per Share (EPS) : EPS=Net Income−Dividends on Preferred StockAverage Outstanding Shares\text{EPS} = \frac{\text{Net Income} – \text{Dividends on Preferred Stock}}{\text{Average Outstanding Shares}}EPS=Average Outstanding SharesNet Income−Dividends on Preferred StockPrice-to-Earnings Ratio (P/E) : P/E Ratio=Market Price Per ShareEarnings Per Share\text{P/E Ratio} = \frac{\text{Market Price Per Share}}{\text{Earnings Per Share}}P/E Ratio=Earnings Per ShareMarket Price Per ShareDebt-to-Equity Ratio : Debt-to-Equity=Total LiabilitiesShareholders’ Equity\text{Debt-to-Equity} = \frac{\text{Total Liabilities}}{\text{Shareholders’ Equity}}Debt-to-Equity=Shareholders’ EquityTotal Liabilities

Example :

Metric Company A Company B EPS (INR) 20 15 P/E Ratio 25 18 Debt-to-Equity 0.5 1.2

2. Qualitative Analysis

Involves non-numerical factors like management efficiency, brand strength, and market positioning.

Key Factors :

Management Quality : Evaluate leadership skills, experience, and strategy.Industry Trends : Assess market demand and competition.Economic Conditions : Analyze macroeconomic indicators like GDP, inflation, and interest rates.

Steps in Fundamental Analysis

Analyze Financial Statements :

Study balance sheets, income statements, and cash flow statements.

Evaluate Industry and Economic Conditions :

Understand industry growth, competition, and market dynamics.

Perform Ratio Analysis :

Use financial ratios to assess profitability, liquidity, and solvency.

Determine Intrinsic Value :

Compare the calculated value with the market price to decide on investment.

Historical Perspective of Fundamental Analysis in India

Evolution Timeline:

Year Event Impact 1990s Economic Liberalization Increased focus on company fundamentals 2000s Advent of Online Trading Platforms Simplified access to financial data 2010s Growth of Retail Participation Popularized fundamental analysis for individuals 2020s Integration of AI and Analytics Enhanced accuracy in fundamental analysis

Case Study: Applying Fundamental Analysis in India

Reliance Industries (2022):

Metric Value EPS (INR) 90 P/E Ratio 30 Debt-to-Equity Ratio 0.5

Analysis :

Strong EPS reflects robust profitability.Moderate P/E Ratio indicates reasonable valuation.Low Debt-to-Equity showcases financial stability.

Result: Suitable for long-term investment due to stable fundamentals.

Benefits of Fundamental Analysis

Reduces Investment Risk :

Provides a comprehensive understanding of a company’s strengths and weaknesses.

Long-Term Focus :

Helps identify sustainable investment opportunities.

Enhanced Decision-Making :

Combines quantitative and qualitative insights for better judgment.

Market Independence :

Focuses on intrinsic value, minimizing reliance on market fluctuations.

Limitations of Fundamental Analysis

Time-Consuming :

Requires detailed examination of financial and qualitative data.

Subjectivity :

Qualitative factors like management assessment are open to interpretation.

Market Volatility :

May not account for short-term market sentiments or news.

Complexity :

Requires expertise in financial analysis and economic indicators.

Comparison: Fundamental Analysis vs. Technical Analysis

Aspect Fundamental Analysis Technical Analysis Focus Intrinsic value of the stock Price movements and patterns Time Horizon Long-term Short-term Tools Used Financial statements, ratios Charts, indicators Objective Evaluate company performance Predict price trends

Tools for Fundamental Analysis in India

Websites :

Moneycontrol, NSE India, and BSE India.

Software :

TickerTape, Screener, and MarketMojo.

Reports :

Annual reports, earnings calls, and sectoral analyses.

Practical Tips for Indian Investors

Focus on Blue-Chip Companies :

Start with well-established companies with consistent performance.

Stay Updated :

Keep track of economic and industry developments.

Use Financial Ratios :

Leverage ratios like P/E and EPS to evaluate stocks.

Diversify :

Spread investments across sectors to minimize risk.

Conclusion

Fundamental Analysis is a vital tool for understanding the intrinsic value of stocks in the Indian share market. By evaluating a company’s financial health, industry position, and economic context, investors can make informed decisions that align with their long-term goals.

Whether you are a novice or an experienced investor, mastering fundamental analysis empowers you to navigate market complexities with confidence. This comprehensive guide equips you with the knowledge and techniques needed to analyze stocks effectively, ensuring a strong foundation for your investment journey.

December 8, 2024

Retained earnings represent the portion of a company’s net profit that is not distributed to …

December 8, 2024

Gifting stocks is an innovative and meaningful way to pass on wealth to loved ones …

December 8, 2024

Step-Up Bonds are a type of fixed-income security that offer increasing interest rates at predetermined …

December 8, 2024

Dabba trading, also known as bucket trading, is an unofficial and illegal method of trading …

December 8, 2024

Outstanding shares refer to the total number of a company’s shares that are currently held …

December 8, 2024

An American Depository Receipt (ADR) is a financial instrument that allows investors in the United …

December 8, 2024

Forfeited shares refer to shares that a company reclaims from a shareholder due to non-payment …

December 8, 2024

Gross Profit and Gross Margin are essential financial metrics used to evaluate a company’s profitability …

December 8, 2024

Dividend Investing is a strategy where investors focus on buying stocks that pay regular and …

December 8, 2024

The Piercing Line Candlestick is a bullish reversal pattern in technical analysis that signals a …

December 8, 2024

The Last Traded Price (LTP) is the most recent price at which a security was …

December 8, 2024

After-hours trading refers to the buying and selling of securities outside the regular trading hours …

December 8, 2024

Fundamental Analysis is a method of evaluating a company’s intrinsic value by examining its financial …

December 8, 2024

The Debt to Asset Ratio is a financial metric that indicates the proportion of a …

December 8, 2024

A Mortgage-Backed Security (MBS) is a financial instrument backed by a pool of mortgage loans. …

December 8, 2024

Prospect Theory, introduced by Daniel Kahneman and Amos Tversky in 1979, is a behavioral economics …

December 8, 2024

An insurance bond is a hybrid financial instrument that combines the benefits of insurance coverage …

December 8, 2024

Rights entitlement refers to the right granted to existing shareholders to purchase additional shares of …

December 8, 2024

Domestic Institutional Investors (DIIs) are financial entities such as mutual funds, insurance companies, banks, and …

December 8, 2024

A bracket order is an advanced trading mechanism that allows traders to manage their risk …

December 8, 2024

Ledger narration is an essential aspect of accounting, particularly in financial domains like the Indian …

December 6, 2024

A Haircut in the financial market refers to the reduction in the value of an …

December 6, 2024

A Rights Issue is a fundraising method where a company offers additional shares to its …

December 6, 2024

Quantitative Easing (QE) is a monetary policy tool used by central banks to inject liquidity …

December 5, 2024

Arbitrage is a trading strategy where traders exploit price differences for the same or similar …

December 5, 2024

Locational arbitrage is a trading strategy where investors exploit price differences for the same financial …

November 30, 2024

Rebalancing of Nifty 50 refers to the periodic process of reviewing and altering the composition …

November 30, 2024

A Market Capitalization-Weighted Index is a stock market index where the weight of each component …

November 30, 2024

The National Stock Exchange (NSE) is India’s leading stock exchange and a critical pillar of …

November 30, 2024

The term Nifty originates from combining the words ‘National’ and ‘Fifty,’ representing the top 50 …

November 28, 2024

Ordinary shares, also known as equity shares, represent ownership in a company. Holders of these …

November 28, 2024

Perpetual bonds, often called “perps,” are a unique class of bonds that have no maturity …

November 25, 2024

A wash sale occurs when an investor sells a security at a loss and repurchases …

November 25, 2024

In the Indian share market, block deals are a crucial aspect of large-scale trading activities. …

November 25, 2024

The Indian share market is known for its dynamic price movements that can often leave …

November 22, 2024

The stock market operates within specific hours, but trading activities often extend beyond these hours …

November 22, 2024

In the world of stock markets, the terms closing price and adjusted closing price are …

November 22, 2024

Gold has long been viewed as a sanctuary for investors during periods of economic turbulence …

November 21, 2024

The share turnover ratio is a critical metric in the stock market, reflecting the liquidity …

November 21, 2024

Private equity (PE) plays a pivotal role in the Indian financial ecosystem by injecting capital …

November 21, 2024

Accounting is the backbone of financial reporting, enabling investors and stakeholders to assess the health …

November 21, 2024

The closing price is a key metric in the stock market, reflecting the last traded …

November 20, 2024

Operating revenues form the backbone of a company’s income statement, representing the earnings generated from …

November 20, 2024

In financial analysis, understanding different components of a company’s income is crucial. One such often-overlooked …

November 20, 2024

Sovereign Wealth Funds (SWFs) are state-owned investment funds that manage a country’s wealth by investing …

November 20, 2024

Understanding the financial performance of a company is essential for any investor. Two critical metrics …

November 20, 2024

The Indian share market is a complex ecosystem with multiple components facilitating various trading activities. …

November 19, 2024

Whipsaw refers to a market condition where the price of a stock or index moves …

November 19, 2024

Blog Title: What is Non-Cumulative Preference Shares? SEO Title: Understanding Non-Cumulative Preference Shares in the …

November 19, 2024

Thinly traded securities refer to financial instruments with low trading volumes on stock exchanges. These …

November 18, 2024

A stock ticker is a running display of real-time stock prices and trading activity for …

November 8, 2024

In the Indian share market, options trading is a popular investment strategy, allowing traders to …

November 8, 2024

The concept of averaging is a fundamental investment strategy that allows investors to manage market …

November 8, 2024

The Anchoring Effect is a psychological bias where an individual relies too heavily on an …

October 29, 2024

Revenge trading is an emotional trading behavior where investors attempt to recoup losses by making …

October 29, 2024

Savings bonds are government-backed securities that allow investors to earn interest while preserving the principal. …

October 29, 2024

Capital Indexed Bonds (CIBs) are debt instruments that help investors protect their investments from inflation. …

October 29, 2024

Eurobonds, a type of international bond issued in a currency different from the home currency …

October 29, 2024

Contingent liabilities are financial obligations that may arise based on future events. Unlike regular liabilities …

September 12, 2024

In the world of stock market investments, dividends are an essential element that attracts investors. …

September 12, 2024

Pyramid trading is a sophisticated investment strategy used by traders and investors to maximize returns …

September 12, 2024

In the modern financial landscape, companies have numerous ways to structure their shares. One unique …

September 12, 2024

Dividend Capture Strategy is a popular approach among traders in the stock market, especially for …

September 12, 2024

Leveraged Exchange Traded Funds (ETFs) are a unique category of financial products that have gained …

September 12, 2024

In the world of investing, value investing is a strategy that has stood the test …

September 12, 2024

Investing in the stock market can be a rewarding experience, especially when it comes to …

September 12, 2024

Investing in the stock market can be a lucrative way to build wealth over time. …

September 12, 2024

Technical indicators are essential tools for traders and investors who seek to understand and predict …

September 12, 2024

In the world of finance and stock market analysis, technical indicators play a crucial role …

September 12, 2024

Stock options have become a common tool for companies to incentivize employees, attract talent, and …

September 12, 2024

The Indian Depository Receipt (IDR) is a unique financial instrument that provides Indian investors with …

September 12, 2024

Stock buybacks, also known as share repurchases, occur when a company decides to purchase its …

September 12, 2024

Stock-based compensation is a popular way for companies to reward employees, align their interests with …

September 12, 2024

The quoted price is a crucial concept in finance, especially in the context of stock …

September 12, 2024

Price discovery is a fundamental concept in financial markets that affects everything from the stock …

September 12, 2024

Investing in shares is one of the most popular ways to grow wealth in India. …

September 12, 2024

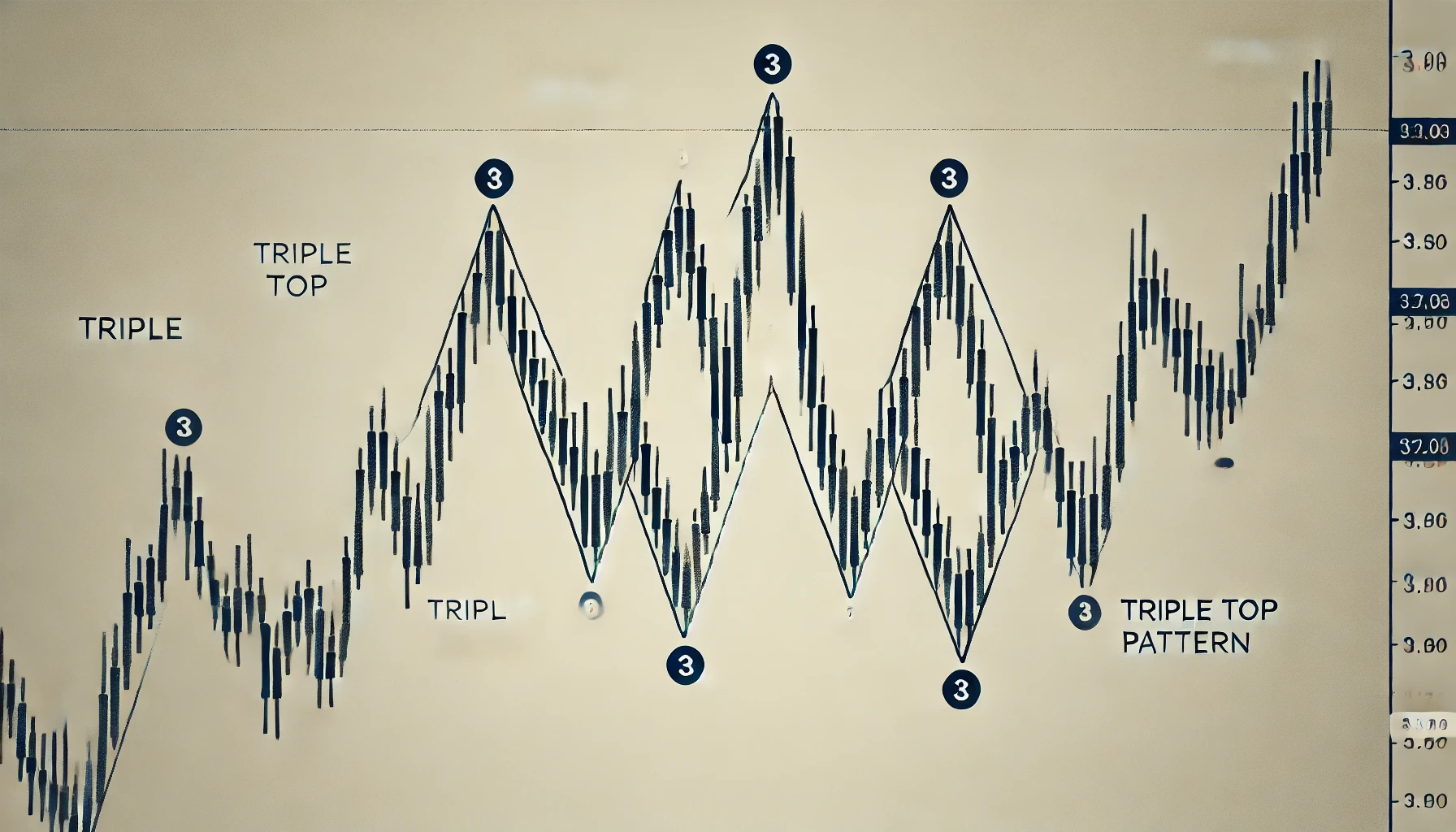

In the world of trading and technical analysis, chart patterns play a significant role in …

September 12, 2024

In technical analysis, candlestick patterns are a crucial tool for traders to understand market sentiment …

September 12, 2024

Technical analysis plays a significant role in financial markets, helping traders make well-informed decisions based …

September 12, 2024

The world of trading offers numerous chart patterns to help traders make informed decisions. One …